5 Things You Should Know About Long-Term Care

Do You Have a Long-Term Care Plan in Place?

Long-term care (LTC) isn’t something anyone likes to think or talk about. After all, no one wants to be a burden to their family, or be forced to move into a nursing facility because of incapacitation. But at Alloy Wealth, we believe having a long-term care plan in place is crucial—even if you never need it.

Here are 5 things you should know:

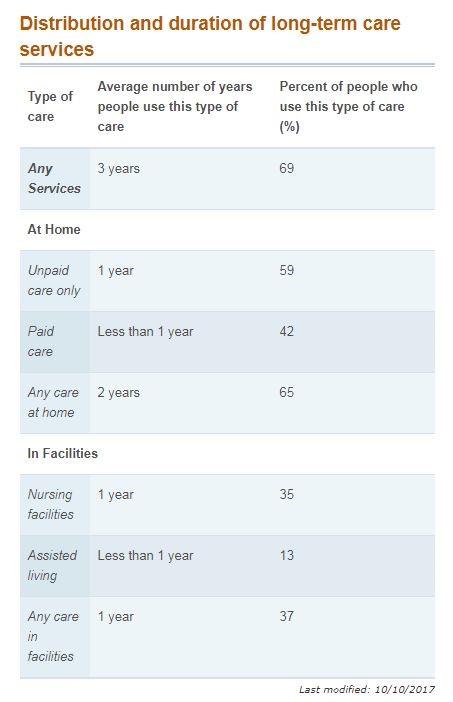

1. 70% of people turning 65 will need some type of long-term care in their lifetime.1

Even though 70% of retirees will need some sort of long-term care, not all of them will need to live in a nursing facility. In fact the data says that only 35% of people 65+ will need to be in a nursing care facility, and only for an average of one year.

2. Unpaid, in-home care (like from a family member) is needed 59% of the time.1

If you are worried about being a burden to your spouse or family someday, unfortunately, that is the most likely scenario, since unpaid, in-home care is utilized by 59% of people 65+. According to recent research by Lincoln Financial Group2— Emotional Aspects of Caregiving —caring for a loved one causes 44% of respondents to feel “overwhelmed.”

3. Medicare doesn’t cover long-term care.2, 8

Many people are under the mistaken belief that Medicare will cover them if they need long-term care like a nursing home. It doesn’t. And to qualify for Medicaid, which does usually cover approved long-term care facilities, a complete spend-down of assets is usually required—which could bankrupt your spouse.

“Medicare does not cover nursing home care except for limited stays after a hospital admission of three days or more. Nor does Medicare pay for in-home care if it’s not skilled nursing care.”

“Medicaid rules are different for every state. But generally, an individual must have $2,000 or less in assets ($3,000 for a couple) before he or she can be eligible for Medicaid.”8

4. Assisted living facilities are used by 13% of people 65 or older.1

There is no nationwide definition for assisted living, although it is regulated in all 50 states. The level of care differs. Here are some of the differences between assisted living facilities and nursing homes:5

“Assisted living residents are mainly independent but may need help with daily living personal care tasks such as bathing and dressing, while nursing home residents tend to need 24-hour assistance with every activity of daily living. Assisted living residents are mobile, while those who are bedridden require nursing homes.”

“Nursing home residents generally have a single or semi-private room, while assisted living residents typically live in a studio or one-bedroom apartment. Nursing home residents require fully staffed, skilled nursing medical attention on a daily basis, while assisted living residents are more stable and do not need ongoing medical attention.”

While Medicaid usually does cover approved nursing homes, it does not cover assisted living facilities. Or at least officially Medicaid doesn’t cover them.

According to Eldercarelaw.com4, “Almost all state Medicaid programs will cover at least some assisted living costs for eligible residents.” Certain aspects of assisted living may be covered on a state-by-state basis, because Medicaid recognizes that it’s cheaper for them.

In 2017, 43 states and Washington DC offer some level of assistance for individuals in assisted living or other forms of non-nursing home, residential care through their Medicaid programs.9

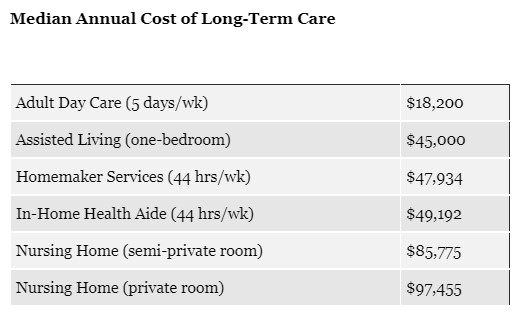

5. The cost of long-term care is increasing.7

The median monthly cost for an assisted living community in the U.S. is $3,750 per month, an increase of 3.36% from 2016, according to Genworth’s annual Cost of Care study. The median annual cost is $45,000.

Compared with assisted living facilities, the cost of nursing home care is nearly double, and continues to increase. Genworth Financial’s 2017 study7 puts the average cost of a semi-private room in a nursing facility at over $85,000, or $7,148 per month, although costs vary by state.

Find costs by state here: https://www.genworth.com/about-us/industry-expertise/cost-of-care.html

Let’s get together and discuss long-term care strategies. Traditional long-term care policies are being replaced by hybrid policies designed for Baby Boomers, like insurance that pays a death benefit if you don’t end up needing long-term care.

As an independent financial advisor, we offer many options as part of your complete retirement plan. Contact Alloy Wealth Management Financial Advisors in Charlotte NC by calling (800) 689-3935.

Sources:

1 U.S. Department of Health and Human Services, Administration on Aging “How much care will you need?” Longtermcare.gov. https://longtermcare.acl.gov/the-basics/how-much-care-will-you-need.html (accessed November 8, 2017).

2 Lincoln Financial Group “Lincoln Financial Group Research Reveals Many Americans Are Not Prepared for Long-Term Care or Caregiving” Newsroom.lfg.com. http://newsroom.lfg.com/press-release/life-insurance/lincoln-financial-group-research-reveals-many-americans-are-not-prepare (accessed November 9, 2017).

3 Think Advisor “New Findings About Long-Term Care Planning Prospects’ Emotions” ThinkAdvisor.com. http://www.thinkadvisor.com/2017/10/31/3-new-findings-about-long-term-care-planning-prosp?eNL=59f8bda5160ba0eb0fa97e56& (accessed November 9, 2017).

4 Elder Law Answers “Medicaid’s Benefits for Assisted Living Facility Residents” Elderlawanswers.com. https://www.elderlawanswers.com/medicaids-benefits-for-assisted-living-facility-residents-15627 (accessed November 8, 2017).

For more information about Medicare’s nursing home coverage, click here.

For more information about Medicaid’s long-term care coverage, click here.

5 A Place For Mom “8 Things You Didn’t Know About Assisted Living” APlaceForMom.com. https://www.aplaceformom.com/blog/things-you-didnt-know-about-assisted-living-2-19-2012/ (accessed November 9, 2017).

6 Financial Planning “The priciest states for assisted living” Financialplanning.com. https://www.financial-planning.com/slideshow/10-most-expensive-states-for-assisted-living (accessed November 9, 2017).

7 Genworth “Compare Long Term Care Costs Across the United States” Genworth.com. https://www.genworth.com/about-us/industry-expertise/cost-of-care.html (accessed November 9, 2017).

8 Forbes “The Staggering Prices Of Long-Term Care 2017” Forbes.com. https://www.forbes.com/sites/nextavenue/2017/09/26/the-staggering-prices-of-long-term-care-2017/#532ecd2e2ee2 (accessed November 9, 2017).

9 Paying for Senior Care “Medicaid’s Assisted Living Benefits: Availability and Eligibility” Payingforseniorcare.com. https://www.payingforseniorcare.com/medicaid-waivers/assisted-living.html (accessed November 9, 2017).