April is Financial Literacy Month. Here Are the Top 10 Things You Should Know.

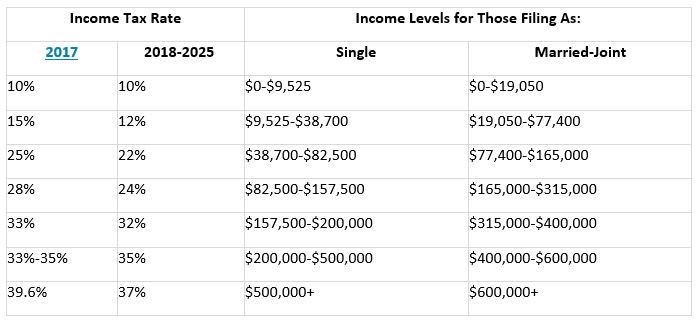

- Tax reform changes a lot of things starting in the 2018 tax year. (And a lot of the new law sunsets in 2026, returning to 2017 levels.)

Under the new tax law passed last December—the “Tax Cuts & Jobs Act”—some of the changes include new tax brackets, new limits to mortgage interest deductions, lower deductions for local property/sales taxes, higher standard deductions, higher estate tax exemptions, and more. We suggest that you meet with both your financial advisor as well as your tax professional to see how you will be affected, and how you might best prepare for 2018 and future taxes.

- 2.

RMDs (Required Minimum Distributions) kick in at age 70-1/2, which can change your tax bracket.

Even people who’ve saved up a large amount of money for retirement are often surprised to find that when they are required to start withdrawing a percentage of their money stashed in tax-deferred accounts like 401(k)s and IRAs every year starting at age 70-1/2, they’re suddenly thrown into a higher income tax bracket, and a big chunk of their savings ends up going to Uncle Sam. Make sure your retirement plan includes tax planning to help mitigate the effect of RMDs.

- 3.

Sequence of returns risk can wipe out retirement money invested in the stock market; that’s what happened to a lot of people in 2008.

No one can predict the timing of a bear market, but if you retire during or right before a market downturn, sequence of returns risk can lead to retirement failure. As a retiree, you don’t have the time horizon to wait for the market to come back up before you withdraw funds needed for income—you need the money to live on. But by withdrawing funds during a market downturn, you amplify your losses, kind of like compound interest in reverse. There are options, just ask us.

- 4.

Insurance can shift financial risk from your family over to an insurance company.

You may be able to take advantage of permanent insurance or annuity policies to help protect your family from a variety of risks depending on your situation; there are all sorts of new policy designs to cover long-term care, lifetime retirement income, spousal survivorship and tax-advantaged wealth transfer.

- 5.

Health care expenses in retirement must be planned for.

Surprise, Medicare isn’t free and doesn’t cover everything. Total projected lifetime health care premiums (Medicare Parts B and D, supplemental insurance, and dental insurance) for a healthy 65-year-old couple retiring this year are expected to be $321,994 in today’s dollars ($485,246 in future dollars). Adding deductibles, copays, hearing, vision, and dental cost sharing, that number grows to $404,253 in today’s dollars ($607,662 in future dollars).

- 6.

Long-term care is not covered by Medicare.

Surprising to many, long-term care (LTC) like going into a nursing facility is not covered by Medicare at all. It can be covered by Medicaid, which requires a complete spend-down of assets (which can bankrupt your spouse and leave nothing for heirs.) A semi-private room costs more than an average of $7,000 per month in 2017. Here are the costs for LTC, broken down by state.

- 7.

You can get a free copy of your credit report once a year by visiting annualcreditreport.com.

We highly recommend that you check your credit reports at least yearly for fraudulent activity using your (potentially-stolen) identity, especially since the Equifax data breach which was all over the news last year.

- 8.

Updating beneficiaries is incredibly important.

The beneficiaries you have listed on your insurance policies, investments, and retirement accounts like IRAs and 401(k)s take precedence over your will and/or trust. There have been court battles over this, and ex-spouses have received money no longer intended for them. Make sure your beneficiaries on all accounts and policies are up to date so that your wishes are carried out. (And update your estate plan regularly, too.) Let’s meet.

- 9.

Know the difference between taxable, tax-deferred and tax-free accounts.

Taxable: Gains or interest received on non-retirement or investment accounts are taxed as income (at your tax bracket for the year) or as short- or long-term capital gains, depending.

Tax-deferred: Income taxes are due on gains when you take money out of tax-deferred retirement accounts like 401(k)s or traditional IRAs. And you have to start taking money out starting at age 70-1/2.

Tax-free: Roth IRA distributions (after age 59-1/2 or if other requirements are met) as well as life insurance benefits may be tax-free in most cases.

- 10.

Only one thing is for certain: change.

Legislation, market conditions, economic events, financial instruments and your family dynamics change over time, so it is important to update your financial/retirement plan at least yearly to help ensure that your plan is on track, your retirement income stream is as safe as possible, and that your strategies are still recommended given your current life situation and analysis of current conditions/opportunities.

If you have questions about your finances or would like to meet, please don’t hesitate to Alloy Wealth Management at (800) 689-3935. And don’t miss our radio show, Living Large Radio, with Mark Henry, Charlotte’s Premiere Wealth Coach.